are funeral expenses tax deductible in australia

Does medical expenditures cover funeral expenses if a relative is killed on your property. Cost of managing tax affairs.

You claim these in your tax return at the specific expense category where available or as an Other deduction.

. Burial expenses such as the cost of a casket and the purchase of a cemetery grave plot or a columbarium niche for cremated ashes can be deducted as well as headstone or grave marker expenses. What funeral expenses are tax deductible. While the IRS allows deductions for medical expenses funeral costs are not included.

Check that all tax obligations are complete before the final distribution of the deceased estate. Estates with net values that dont reach exemption thresholds cant deduct funeral expenses because it would serve no purpose. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim them.

Funeral bonds and prepaid funerals. This means that you cannot deduct the cost of a funeral from your individual tax returns. Individual taxpayers cannot deduct funeral expenses on their tax return.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Funeral expenses arent deductible on a Read. In short these expenses are not eligible to be claimed on a 1040 tax form.

Some estates may be able to deduct funeral expenses. There are a few exceptions though including final medical expenses and costs incurred by the decedents estate. However most estates dont qualify for this deduction unless the estate reaches the threshold of 12060000 the federal.

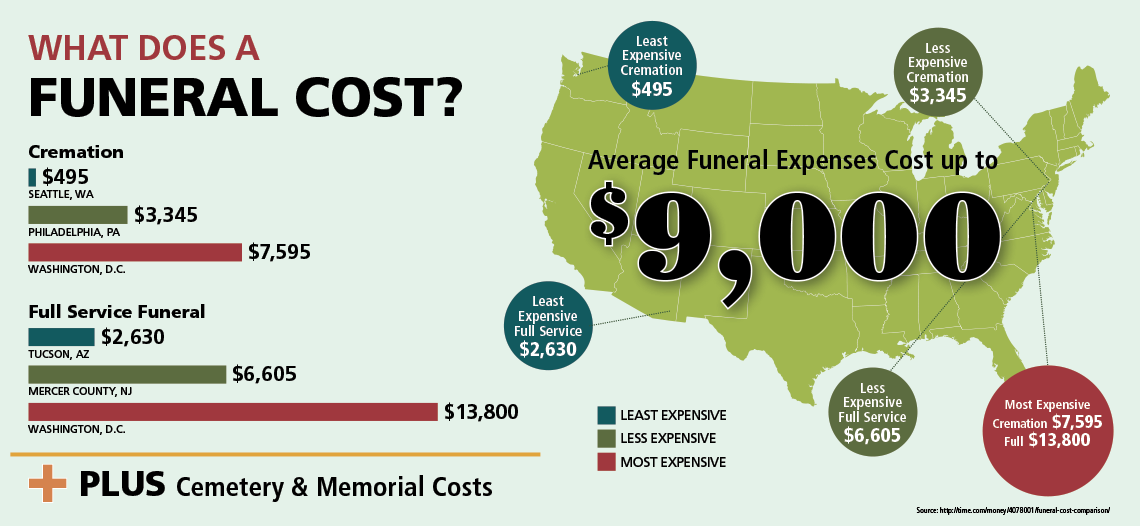

Qualified medical expenses must be used to prevent or treat a medical illness or condition. While the IRS allows deductions for medical expenses funeral costs are not included. The average funeral costs between 7000 and 12000.

An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care of the lot. Are gravestones tax deductible. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs.

Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible. What is considered a funeral expense. Funeral expenditures arent deductible on the individual 1040 income tax return.

Common claims at this section include expenses such as. Individual taxpayers cannot deduct funeral expenses on their tax return. You may also be able to claim a deduction for other expenses you incur that dont relate to your work or income producing activities.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. Funeral expenses are NOT deductible on a person taxpayers tax return. More estates may be eligible for state tax deductions as many states have estate tax exemptions set much lower than the federal government.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The taxes are not deductible as an individual only as an estate. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

There are some exceptions. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. If you are a beneficiary of a deceased estate Work out if there is tax on money or assets you inherited or are presently entitled to.

Taxpayers are asked to provide a breakdown of the expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition. The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body.

According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. With burial costs being a significant expense its common to wonder if funeral expenses are tax-deductible.

The Australian Tax Office has recently confirmed that small businesses would be able to deduct ping-pong tables if used in the business but a whole range of employee entertainment expenses are. While the IRS allows deductions for medical expenses funeral costs are not included. Ineligible expenses include venue hire or catering for a wake and headstonememorial costs.

However only estates worth over 1206 million are eligible for these tax deductions. Can you file funeral expenditures on income taxes. Who cannot deduct funeral expenses.

Deducting funeral expenses as part of an estate. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Further according to other tax regulations the IRS says its unlikely that individuals will qualify for a funeral expenses deduction. While individuals cannot deduct funeral expenses eligible estates may be able to claim. Funeral expenses are recognized as legitimate estate tax deductions subject to certain rules.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. Are funeral expenses deductible.

Unfortunately individual taxpayers cannot claim funeral expenses under the medical expenses deductible. What to do when someone dies getting authority to deal with the ATO lodging a final tax return and trust tax returns. Individual taxpayers cannot deduct funeral expenses on their tax return.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Select your payment or service to find out how this impacts you. Are funeral expenses tax deductible in Australia.

Funeral costs you pay for in advance normally dont count in your assets test for payments from us. Theyre not liable for an estate tax and dont have to file estate tax returns.

What Do You Know About Life Insurance

How To Deduct Medical Expenses On Your Taxes Smartasset

How To Deduct Medical Expenses On Your Taxes Smartasset

Taxes In Austria Everything You Need To Know Expatica

How To Add Independent Contractors And Track Them For 1099s In Quickbooks Online

Sars Tax Deductible Business Expenses Listed Deductions

Dying With Debt Can Prove Costly For The Survivors

What Are Non Deductible Expenses Rydoo

Understanding Tax Deductions For Charitable Donations

Using Section 139 To Give Tax Free Payments To Staff During A National Disaster

How To Deduct Medical Expenses On Your Taxes Smartasset

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

How To Add Independent Contractors And Track Them For 1099s In Quickbooks Online

Top Organizations That Help With Funeral Expenses